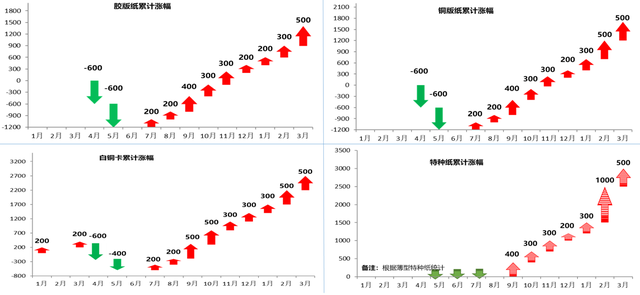

Since August 2020, China’s finished paper (cultural paper, packaging paper, household paper, etc.) has been raising prices frequently. Up to now, the prices of major packaging paper and cultural paper products are still rising sharply, which has given downstream companies in the industry chain Normal production and operation have a great impact.

After experiencing the downturn after the epidemic, the price of white cardboard began to continue and rapidly lead the rise. The data shows that the price of conventional white cardboard has continued to risefrom RMB 5,400/ton in June 2020 to RMB 7,700/ton in January 2021, an increase of 43%, reaching the highest point since 2013. Several companies of different sizes, but their actions are “uniform”, with the same increase and reasons. The financial report of a leading white card company is expected to achieve a net profit of 830 million to 850 million yuan in 2020, a year-on-year increase of 514%-534.%. Round white cardboard is a veritable leading variety. This wave of cardboard paper, corrugated paper, coated paper, double offset paper and other paper prices also rose, but the increase was basically around 20%, which was significantly different from white cardboard.

The price of white cardboard rose from 5500/ton to over 10,000 yuan/ton now. Some organizations predict that in the medium and long term, the prices of various paper grades will enter an upward phase in 2021.

The Ministry of Ecology and Environment of China stated that from 2021, China will completely ban the import of solid waste, and the Ministry of Ecology and Environment will no longer accept and approve applications for the import of solid waste. This also means that the import of domestic waste paper will be completely banned in 2021. In 2020, the domestic waste paper pulp demand gap will be 3.8 million tons, and this gap will take some time to be mediated by the market.

Plastic restrictions are good for paper, and the demand for paper has further increased, adding new vitality to the market, especially in food packaging and the demand for packaging bags. According to relevant statistics, the cumulative output of plastic products in my country in 2019 alone reached more than 81 million tons, of which plastic straws were 30,000 tons. There are already substitutes for paper straws, and it is understandable that paper will become a substitute for plastic.

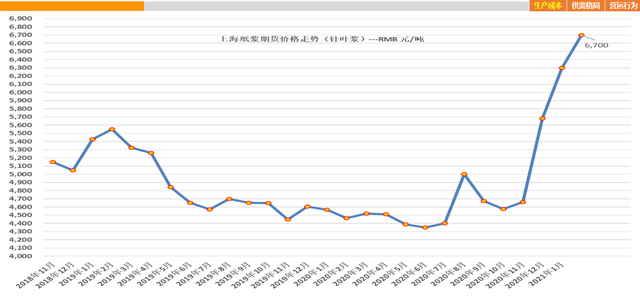

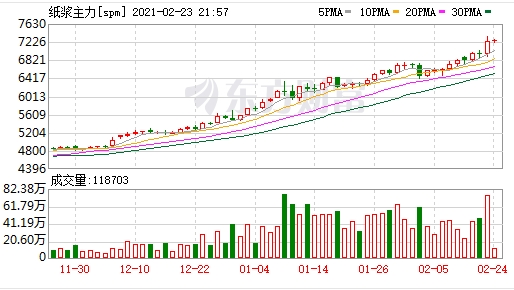

The main pulp futures contract 2103 has risen from the lowest price of 4,620 yuan/ton on November 2 last year to the current (early February) highest price of 7,250 yuan/ton. In less than 4 months, the pulp futures price has risen by more than 2,600 yuan/ton. Up to 56.9%

There are many reasons behind the price increase of paper, ranging from the initial macro recovery and loose economic atmosphere, to the increase in the cost of CME timber, to the tight container, insufficient railway capacity, and the increase in freight rates. Among them, the most mainstream factor is waste paper. The two-way benefit brought by the import ban policy and the new plastic restriction order. In summary, it is mainly because of the following three points: prohibiting the import of waste paper, restricting the use of plastic products, and soaring pulp prices.

In order to maintain the original quality, our price may increase, but the price must be a reasonable price.

We have many raw material supplier who have cooperated for over 20 years, they will give our company a lower prices with same quality.

we can control the paper cost well, so we are able to give you a very competitive price!

Copyright © 2025 Guangzhou Dezheng Printing Co., Ltd. | All Rights Reserved

Hello, please leave your name and email here before chat online so that we won't miss your message and contact you smoothly.